Naperville, IL 60563

Recent Blog Posts

What Is an Exclusive Use Clause in a Commercial Lease?

If you find the right retail space in a great location with strong foot traffic and you’re ready to sign, it can be difficult to slow down and ask whether you’ve thought through every contingency. Here’s one question not enough business owners ask themselves: What happens if a direct competitor moves into the same shopping center six months from now?

If you find the right retail space in a great location with strong foot traffic and you’re ready to sign, it can be difficult to slow down and ask whether you’ve thought through every contingency. Here’s one question not enough business owners ask themselves: What happens if a direct competitor moves into the same shopping center six months from now?

If your commercial lease does not say anything about this situation, the answer may not be one you like. If you’re a business owner looking at a new commercial lease in 2026, you need to understand exclusive use clauses and how they work before signing anything. Our DuPage county commercial real estate attorney can review your lease and make sure your interests are completely protected.

What Is an Exclusive Use Clause in a Commercial Lease?

An exclusive use clause is a provision in a commercial lease that gives a tenant the right to be the only business of a specific type at a property or shopping center. In plain terms, it stops your landlord from renting space to your direct competitors in the same location.

When Do Commercial Developers Need Change-of-Use Permits?

Commercial development in Illinois is growing fast. Last year alone, the state reached a record $13 billion in incentivized investments according to the Illinois Department of Commerce and Economic Opportunity. With this growth comes important questions about zoning and permits. One of the most important permits commercial developers need to understand is the change-of-use permit.

Commercial development in Illinois is growing fast. Last year alone, the state reached a record $13 billion in incentivized investments according to the Illinois Department of Commerce and Economic Opportunity. With this growth comes important questions about zoning and permits. One of the most important permits commercial developers need to understand is the change-of-use permit.

A change-of-use permit is required when you want to change how a commercial property is used. For example, if you want to turn an old warehouse into a restaurant or change a retail store into an office building, you need approval from your local municipality. The process can be complex, and mistakes can delay your project for months or even force you to redesign your plans completely.

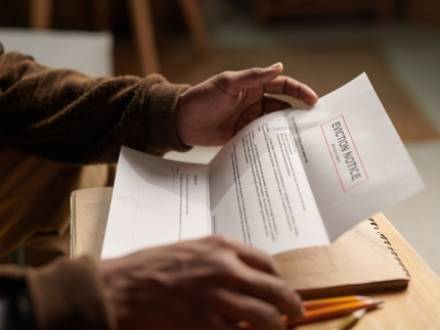

What to Do When a Commercial Tenant Stops Paying Rent

Very few situations create more stress for commercial landlords than a tenant who stops paying rent. Your mortgage, property taxes, insurance, and maintenance costs don’t magically disappear just because your tenant has financial trouble. And the longer the situation continues, the more money you lose.

Very few situations create more stress for commercial landlords than a tenant who stops paying rent. Your mortgage, property taxes, insurance, and maintenance costs don’t magically disappear just because your tenant has financial trouble. And the longer the situation continues, the more money you lose.

The good news is that Illinois law provides landlords with clear remedies when commercial tenants default on their lease obligations. The faster you act, the better protection you give yourself. Our Oak Brook, IL commercial landlord’s attorneys can help you move forward in 2026 so that you can protect your business dealings with the best odds of recovering unpaid rent.

How Common Is Commercial Rent Delinquency Right Now?

If you are dealing with a tenant who has fallen behind on rent, you are not alone. Commercial rent delinquency has increased substantially in recent years, affecting landlords across all property types.

Common Reasons Commercial Real Estate Deals Fail Before Closing

Buying or selling commercial property is a major financial decision for a business owner or investor to make. Unfortunately, not every promising deal makes it to the closing table. Research suggests that roughly 50 percent of commercial real estate transactions fall apart during the due diligence phase, often catching both parties off guard.

Buying or selling commercial property is a major financial decision for a business owner or investor to make. Unfortunately, not every promising deal makes it to the closing table. Research suggests that roughly 50 percent of commercial real estate transactions fall apart during the due diligence phase, often catching both parties off guard.

Understanding why deals fail can help you avoid these pitfalls in your 2026 commercial dealings. Whether you are a landlord selling a retail center, or an investor acquiring a distressed building, our Naperville commercial real estate attorneys can work to save you time and money.

How Illinois Law Treats Cloud-Based Data Theft

The pandemic forced many people to work from home; however, after the pandemic ended, many companies realized that their workers could get the same amount of work done, either entirely remotely or as hybrid workers – part-time at home and part-time in the office. With the advances in technology, along with the changes in "traditional" workplaces, an employee could conceivably walk out with a company’s most valuable information on a Google Drive or Dropbox folder.

The pandemic forced many people to work from home; however, after the pandemic ended, many companies realized that their workers could get the same amount of work done, either entirely remotely or as hybrid workers – part-time at home and part-time in the office. With the advances in technology, along with the changes in "traditional" workplaces, an employee could conceivably walk out with a company’s most valuable information on a Google Drive or Dropbox folder.

This information might include pricing data, proprietary software, client lists, or other crucial data. Under Illinois law, this is more than just a breach of policy; it can be classified as trade-secret theft under the Illinois Trade Secrets Act (765 ILCS 1065) and even criminal theft (720 ILCS 5/16-1).

Ghost Malls to Growth Hubs: Repurposing Malls in Illinois

Malls were the heart of American consumer culture for decades, reaching their peak popularity in the 1970s and 1980s. Families dined, shopped, and gathered in malls, and teens congregated. Shopping mall construction in Illinois reached its peak in the mid-1980s. By the late 1990s, a significant decline in mall construction had occurred as consumers began to prefer the convenience and lower prices offered by big-box retailers.

Malls were the heart of American consumer culture for decades, reaching their peak popularity in the 1970s and 1980s. Families dined, shopped, and gathered in malls, and teens congregated. Shopping mall construction in Illinois reached its peak in the mid-1980s. By the late 1990s, a significant decline in mall construction had occurred as consumers began to prefer the convenience and lower prices offered by big-box retailers.

This shift led to the emergence of "dead" or "ghost" malls, which struggled to attract shoppers to underperforming shops. Many ended up shutting their doors for good. Neglect from owners led to building code violations, making this type of commercial real estate difficult to sell and expensive to demolish. Rather than bulldoze these massive commercial properties, Illinois developers began embracing "adaptive reuse." Adaptive reuse involves finding new – and sometimes surprising – ways to breathe life back into ghost malls.

10 Due Diligence Considerations for Buyers in Commercial Real Estate Purchases

When purchasing commercial property, a buyer must look beyond the bricks and mortar. One of the most important parts of due diligence involves reviewing the existing tenant leases. Leases dictate the property’s income, the landlord’s responsibilities, and potential risks that carry over to the new owner. Overlooking these provisions can mean inheriting expensive financial obligations or problematic restrictions that limit future use of the property.

When purchasing commercial property, a buyer must look beyond the bricks and mortar. One of the most important parts of due diligence involves reviewing the existing tenant leases. Leases dictate the property’s income, the landlord’s responsibilities, and potential risks that carry over to the new owner. Overlooking these provisions can mean inheriting expensive financial obligations or problematic restrictions that limit future use of the property.

If you are considering a purchase of commercial property, working with an Oak Brook commercial real estate lawyer who has both advanced real estate training and over 20 years of legal experience can provide significant protection. Below are 10 critical considerations for reviewing tenant leases. This list is not exhaustive but highlights some of the most common issues buyers face as they try to protect themselves and remain compliant with Illinois contract law.

Triple Net (NNN) vs. Gross Leases: Which Is Better for Business?

Choosing the right type of commercial lease is one of the most important decisions a business owner will make, especially when the business is first beginning. Throughout DuPage County, commercial property agreements generally fall into two categories: triple net (NNN) leases and gross leases.

Choosing the right type of commercial lease is one of the most important decisions a business owner will make, especially when the business is first beginning. Throughout DuPage County, commercial property agreements generally fall into two categories: triple net (NNN) leases and gross leases.

Each structure has its advantages and potential drawbacks, and understanding the differences is crucial before signing a lease that could affect your bottom line for years to come. At Lindell & Tessitore, P.C., our Naperville, IL commercial real estate attorneys can help you choose the right commercial lease, negotiate favorable terms, and manage any other issues that come up in the course of doing business.

What Is a Triple Net (NNN) Lease?

In a triple net lease, the tenant pays the base rent to the landlord but also assumes responsibility for three major expense categories:

What Is the Role of Discovery in Commercial Litigation?

If your company becomes involved in a lawsuit, it can help to familiarize yourself with one of the most critical and often least understood aspects of litigation: the discovery process. Whether you are the plaintiff or the defendant, discovery can significantly affect the outcome of your case and the cost of resolving it. Understanding how litigation discovery works and what it means for you can give you an edge in a lawsuit. An experienced Naperville, IL commercial litigation attorney can represent you in your commercial litigation.

If your company becomes involved in a lawsuit, it can help to familiarize yourself with one of the most critical and often least understood aspects of litigation: the discovery process. Whether you are the plaintiff or the defendant, discovery can significantly affect the outcome of your case and the cost of resolving it. Understanding how litigation discovery works and what it means for you can give you an edge in a lawsuit. An experienced Naperville, IL commercial litigation attorney can represent you in your commercial litigation.

What Is Discovery?

Discovery is the formal process whereby each party in a lawsuit extracts information related to the case. This includes documents, emails, financial records, contracts, and even internal communications. It may also involve answering written questions (interrogatories), sitting for depositions (sworn testimony outside of court), or producing electronic data. The purpose of discovery is to ensure both sides have access to the facts before trial. In many cases, particularly in commercial litigation, it is the primary source of evidence in a lawsuit. It is such an important tool that smoking gun documents have won or lost cases.

What Are Your Options for Challenging Illinois Zoning Use Laws?

Zoning ordinances can have a significant impact on commercial real estate owners and developers. They are intended to ensure that neighborhoods and land are used according to what is best for the community. They also ensure standards are in place for land development. Zoning ordinances determine how land can be used–whether for residential, commercial, or industrial use.

Zoning ordinances can have a significant impact on commercial real estate owners and developers. They are intended to ensure that neighborhoods and land are used according to what is best for the community. They also ensure standards are in place for land development. Zoning ordinances determine how land can be used–whether for residential, commercial, or industrial use.

They can create conflict for a commercial real estate business owner seeking to develop their property to its fullest potential. The good news is that it is possible to challenge zoning decisions. An experienced DuPage County, IL zoning and development attorney can advise you on your options for challenging zoning use ordinances, and represent you throughout the process.

What Are the Options for Challenging Zoning Use Ordinances?

There are several different ways to challenge zoning use laws. If your request is denied, you can appeal that decision.