Naperville, IL 60563

Recent Blog Posts

Expanding Your Investment Portfolio - Why Now is the Time to Invest in Commercial Real Estate

During the U.S. economy crash of 2018, financially savvy investors jumped into the real estate market. Many started out in residential properties, which were being repossessed at an unprecedented rate. Most of the properties were distressed, but substantial profits were still made. Now, with climbing rates and other indicators of market shifts, residential investors are being encouraged to expand their portfolios. One sector worth considering is the commercial real estate (CRE) market. Learn why, and discover how an experienced real estate attorney can minimize you minimize the potential risks in the following sections.

During the U.S. economy crash of 2018, financially savvy investors jumped into the real estate market. Many started out in residential properties, which were being repossessed at an unprecedented rate. Most of the properties were distressed, but substantial profits were still made. Now, with climbing rates and other indicators of market shifts, residential investors are being encouraged to expand their portfolios. One sector worth considering is the commercial real estate (CRE) market. Learn why, and discover how an experienced real estate attorney can minimize you minimize the potential risks in the following sections.

Why Commercial Real Estate?

With the possibility of turbulent markets ahead, investors are encouraged to add more stable equity to their portfolios. Commercial real estate typically offers a better risk-return profile than other real estate sectors. For example, the absolute return on CRE backed by private debt (secured debt with a collateral contingency) ranges between 6 and 12 percent. Additionally, this sector does not experience the same daily swings as other markets. Use of collateral in a commercial real estate transaction can also minimize the risk of a default, and it ensures there is an asset safety net, should default, or a decline in the market occur.

Forbes Real Estate Council Reveals which Real Estate Markets Are Booming in 2018

To be successful as a real estate investor, you need a vision. More importantly, you need to be willing to change your vision, according to the market trends. For example, you may have started out as an investor who buys and flips houses, but the trends show that such investors are making smaller returns. As such, you may need to expand your portfolio into another market (i.e. commercial real estate or residential rental properties).

To be successful as a real estate investor, you need a vision. More importantly, you need to be willing to change your vision, according to the market trends. For example, you may have started out as an investor who buys and flips houses, but the trends show that such investors are making smaller returns. As such, you may need to expand your portfolio into another market (i.e. commercial real estate or residential rental properties).

Where you invest is also important. After all, it does little good for one to invest in areas that are distressed or declining. To help you find direction, the Forbes Real Estate Council recently revealed which market areas are expected to boom in 2018. Furthermore, you shall learn how the aid of a seasoned real estate attorney can help guide your investment choices for the future.

Banks Agree to Relax CRE Lending Rules

After the recession, banks tightened their lending requirements for all borrowers. Individuals in the commercial real estate market took the hardest hit. Several institutions stopped offering lending options to CRE investors altogether, and all remaining lenders were bound by federal regulations. Of particular concern was the requirement that all CRE transactions valued at $250,000 or higher had to be valued by an independent third-party. Thankfully, the Federal Reserve, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) has recently relaxed this requirement. Learn why this matters and how it could give you the freedom you need to expand your investment portfolio in the following sections.

After the recession, banks tightened their lending requirements for all borrowers. Individuals in the commercial real estate market took the hardest hit. Several institutions stopped offering lending options to CRE investors altogether, and all remaining lenders were bound by federal regulations. Of particular concern was the requirement that all CRE transactions valued at $250,000 or higher had to be valued by an independent third-party. Thankfully, the Federal Reserve, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) has recently relaxed this requirement. Learn why this matters and how it could give you the freedom you need to expand your investment portfolio in the following sections.

Relaxed Lending and Your Investment Portfolio

Survey Reveals CRE Market's Biggest Concerns in 2018

The risk that an investor assumes during commercial real estate transactions can be largely attributed to the industry's volatile nature. However, there are additional factors at play as well. In fact, the third annual Real Estate Market Sentiment Survey revealed that there are two main issues concerning real estate executives for the year 2018: rising interest rates, and supply and demand. Learn more about these concerns in the following sections, including how an experienced commercial real estate attorney can help you to mitigate the risks that you could face in your next commercial real estate project.

The risk that an investor assumes during commercial real estate transactions can be largely attributed to the industry's volatile nature. However, there are additional factors at play as well. In fact, the third annual Real Estate Market Sentiment Survey revealed that there are two main issues concerning real estate executives for the year 2018: rising interest rates, and supply and demand. Learn more about these concerns in the following sections, including how an experienced commercial real estate attorney can help you to mitigate the risks that you could face in your next commercial real estate project.

CRE's Rising Interest Rates

Rising interest rates within the CRE market have been a concern for some time now, which is why most savvy investors and executives have taken steps to prepare for the inevitable. Unfortunately, preparation can only take a person so far – especially if interest rates exceed the market's “pain threshold,” the rate at which investors and executives are likely to be adversely affected. Industry experts say this threshold falls at about 150 basis points, and that the market could far exceed it in 2018, which has many investors concerned. Thankfully, there are some smart investment moves that industry executives can use to grow and expand their portfolio, even in the face of rising interest rates.

When a Desire for Aesthetics Causes Zoning Complaints in Your Neighborhood

One might like to think that they can do whatever they want with their property, but as one Illinois family is learning, that is not always the case. After purchasing a swing set for their children and placing it in the front yard, someone filed a complaint and they received notice that they were in violation of the local zoning laws. Now they are at risk of being forced to remove the swing set and they may even incur fees – all because of neighborhood aesthetics. What can you do if faced with a similar situation? The following explains.

One might like to think that they can do whatever they want with their property, but as one Illinois family is learning, that is not always the case. After purchasing a swing set for their children and placing it in the front yard, someone filed a complaint and they received notice that they were in violation of the local zoning laws. Now they are at risk of being forced to remove the swing set and they may even incur fees – all because of neighborhood aesthetics. What can you do if faced with a similar situation? The following explains.

Why Zoning Laws Exist

In the right context, zoning laws can preserve communities. As an example, zoning laws do not permit industrial development in certain residential areas; this protects the community from noise and air pollution and preserves its aesthetics. Unfortunately, some communities can go overboard with their zoning laws. They become overly restrictive, prohibiting anything and everything that makes each home unique.

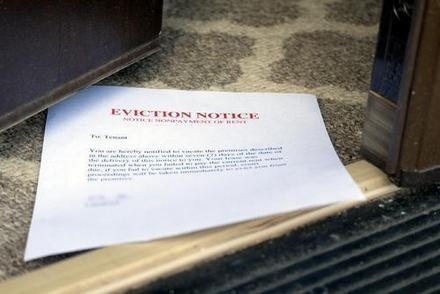

Tenant-Landlord Disputes - Actions That Can and Cannot Be Taken by a Landlord or Tenant

While most tenant-landlord relationships end with little fanfare, there are situations in which one must take some form of action against the other. For example, a landlord that has denied a tenant of suitable living conditions may be held legally liable for their actions. In contrast, a tenant who has failed to pay their rent may be evicted through legal action. The following information explains those actions, and it provides details on actions that cannot be taken by either a landlord or tenant. You shall also learn how the assistance of an experienced attorney could improve the outcome of your landlord-tenant dispute.

While most tenant-landlord relationships end with little fanfare, there are situations in which one must take some form of action against the other. For example, a landlord that has denied a tenant of suitable living conditions may be held legally liable for their actions. In contrast, a tenant who has failed to pay their rent may be evicted through legal action. The following information explains those actions, and it provides details on actions that cannot be taken by either a landlord or tenant. You shall also learn how the assistance of an experienced attorney could improve the outcome of your landlord-tenant dispute.

Permitted and Restricted Actions for Tenants

When a landlord is in default of the lease, tenants have only a few permitted actions they can take. If the residence is uninhabitable, or if the landlord is refusing to make repairs that have caused the property to become unfit (Chicago only), the tenant may then file an official complaint with the landlord. While this is nothing more than a letter that states your concerns and intentions, should the landlord fail to make the appropriate repairs, it

Technology and the Commercial Real Estate Market – How Things Have Changed and What Lies Ahead

Technology has impacted every major industry in the world, including the commercial real estate market – but how? Do the changes affect everyone in the CRE sector or just some people? Also, what can investors expect in the future? The following information explores the answers to these questions, and it provides details on where you can find quality assistance to meet your commercial real estate and investment needs.

Technology has impacted every major industry in the world, including the commercial real estate market – but how? Do the changes affect everyone in the CRE sector or just some people? Also, what can investors expect in the future? The following information explores the answers to these questions, and it provides details on where you can find quality assistance to meet your commercial real estate and investment needs.

How Shifts in Purchasing Behavior Are Affecting CRE

If you have noticed that you are buying more things online and fewer things at the store, you are not alone. In fact, most Americans can say the same thing. What does all this have to do with CRE? Investors who once built shopping malls and shopping centers are struggling, but many who have purchased warehouse space are seeing a boom.

The Need for Improved Data Collection and Communication

Commercial Real Estate Booming Across the Country – Does It Suggest an Uptick for Illinois?

The commercial real estate market is booming all throughout the country, but does that necessarily mean that Illinois is in for a boom of its own? Not in the least. In fact, even novice trend predictors will tell you that you cannot make buying decisions based on trends alone. Instead, a wide array of variables must be considered – and some of them may be unique to the state, county, or city in which you wish to buy or develop property. So, whether it is zoning laws, market trends, or population growth projections that are encouraging you to examine Illinois, consider the following tips for deciding if this area may be right for your next project. You shall also learn what an experienced real estate attorney can do to ensure your best interests are protected.

The commercial real estate market is booming all throughout the country, but does that necessarily mean that Illinois is in for a boom of its own? Not in the least. In fact, even novice trend predictors will tell you that you cannot make buying decisions based on trends alone. Instead, a wide array of variables must be considered – and some of them may be unique to the state, county, or city in which you wish to buy or develop property. So, whether it is zoning laws, market trends, or population growth projections that are encouraging you to examine Illinois, consider the following tips for deciding if this area may be right for your next project. You shall also learn what an experienced real estate attorney can do to ensure your best interests are protected.

Taking a Closer Look Commercial Real Estate “Boom”

Dealing with Environmental Issues in Your CRE Development Project

Environmental issues can arise in any real estate transaction, but their potential consequences are often most severe in commercial real estate (CRE) settings. Part of the reason for this is simple: CRE projects involve more time, money, and resources. However, there are some additional obstacles that CRE investors may face when dealing with environmental issues. Learn how to mitigate against such issues in the following sections, and discover how an experienced real estate attorney can help protect your interests in your next CRE development project.

Environmental issues can arise in any real estate transaction, but their potential consequences are often most severe in commercial real estate (CRE) settings. Part of the reason for this is simple: CRE projects involve more time, money, and resources. However, there are some additional obstacles that CRE investors may face when dealing with environmental issues. Learn how to mitigate against such issues in the following sections, and discover how an experienced real estate attorney can help protect your interests in your next CRE development project.

Common Environmental Concerns in CRE Development

Environmental concerns in CRE development projects can include soil and water contaminants, building contaminants, and noxious gas or vapor contaminants. Mold, lead, asbestos, and radon are some of the most commonly seen contaminants in real estate. Contamination may originate either onsite (from the activities of builders and previous owners) or off-site (contaminants that have leeched or been brought onto the work site).

How Might the President's Immigration Plan Affect the Commercial Real Estate Market?

As the political environment in America heats up, and individuals begin to consider how the proposed government changes may impact their personal lives, it becomes more clear that everyone has a reason to be concerned. For those in the commercial real estate (CRE) market, the major concern is President's proposed immigration party. Learn more about why the two are connected and discover how an experienced real estate lawyer can help you mitigate against any possible problems in your next commercial project.

As the political environment in America heats up, and individuals begin to consider how the proposed government changes may impact their personal lives, it becomes more clear that everyone has a reason to be concerned. For those in the commercial real estate (CRE) market, the major concern is President's proposed immigration party. Learn more about why the two are connected and discover how an experienced real estate lawyer can help you mitigate against any possible problems in your next commercial project.

Proposed Immigration Plan Could Impact CRE Market

Last month, President Trump announced that the number of immigrants allowed into the United States would decrease drastically over the next decade – to about half. Unfortunately, such a plan could negatively affect the CRE market is several ways. First, it could hurt the labor market. That, in turn, could impact the housing market. Secondly, the budding area of Chicago and its surrounding suburbs may be in trouble if the President's legislation passes. Families may opt for another place to live. Businesses may leave. Worst of all, Illinois – a state that has been struggling tremendously with budgets and fiscal decisions – may never fully recover.