Naperville, IL 60563

Recent Blog Posts

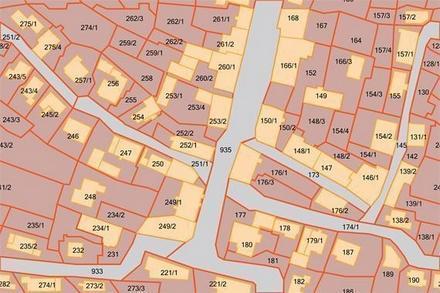

How Changes to Zoning and Land Use Laws Can Impact Land Development Projects

When it comes to zoning and land use laws, developers need to consider more than just the present situation. Unexpected or unplanned changes can occur - sometimes to the detriment of your project. Learn more about how changes in zoning and land use laws may impact your current or prospective land development project, and discover how our seasoned Naperville commercial real estate attorneys can help you mitigate against such issues.

When it comes to zoning and land use laws, developers need to consider more than just the present situation. Unexpected or unplanned changes can occur - sometimes to the detriment of your project. Learn more about how changes in zoning and land use laws may impact your current or prospective land development project, and discover how our seasoned Naperville commercial real estate attorneys can help you mitigate against such issues.

When Zoning and Land Use Laws Change

Municipalities tend to have a long-term vision for the way they want their town or city developed. Typically based on a variety of factors, such as land or wildlife preservation; values, needs, and desires of the community; and earning or tourist potential, this vision is usually outlined far in advance. Of course, things change. Perhaps the population ages or the town experiences a significant and unexpected influx of young people or successful entrepreneurs. Maybe the area starts to flood or suffer from erosion, or an indigenous species become endangered. Regardless of the reason, the city must then attempt to accommodate the change. That may require alterations to their plan, or even to zoning and land use laws.

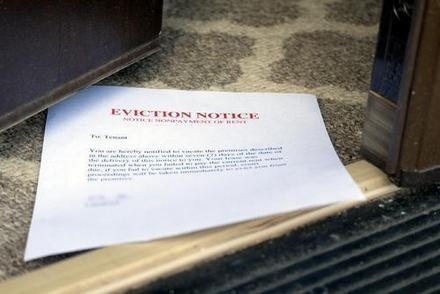

Mediating or Negotiating a Landlord-Tenant Dispute - What Every Tenant Should Know

Living under the roof of another person can require a lot of compromises - but what can you do if compromise fails, or if your landlord refuses to hear your side of thing? Tenants often assume that a lawsuit is the answer, but this method is usually both complex and expensive. Thankfully, there are other tools and resources that tenants can use to resolve issues with their landlords. Learn more about them in the following sections, and discover how a seasoned Naperville real estate lawyer can help you resolve your landlord-tenant dispute.

Living under the roof of another person can require a lot of compromises - but what can you do if compromise fails, or if your landlord refuses to hear your side of thing? Tenants often assume that a lawsuit is the answer, but this method is usually both complex and expensive. Thankfully, there are other tools and resources that tenants can use to resolve issues with their landlords. Learn more about them in the following sections, and discover how a seasoned Naperville real estate lawyer can help you resolve your landlord-tenant dispute.

Negotiating a Settlement with Your Landlord

Many landlord-tenant issues can be resolved through a negotiation - a process in which parties compromise to reach a suitable resolution. You can do this with or without a mediator (an unbiased third-party that can help you and your landlord reach a suitable agreement). To increase your chances of success in the process, try a few of these helpful hints:

CRE Partnerships - Avoiding Some of the Most Common Partnership Killers

Partnerships in the commercial real estate (CRE) industry can either make or break your business. Most savvy investors understand this, but they may not fully understand what factors may lead them to a path of success. Learn more in the following sections, including how the assistance of a seasoned commercial real estate lawyer can help improve your chances of growing a healthy and profitable business now, and in the years to come.

Partnerships in the commercial real estate (CRE) industry can either make or break your business. Most savvy investors understand this, but they may not fully understand what factors may lead them to a path of success. Learn more in the following sections, including how the assistance of a seasoned commercial real estate lawyer can help improve your chances of growing a healthy and profitable business now, and in the years to come.

Partnerships that are born out of financial convenience (i.e. because you lack capital or cannot afford to hire someone for the job) are rarely profitable. That is partly because only one person is bringing in the money, but there are other issues that can cause these partnerships to fail as well. For example, if you partner with someone who does not have the business sense to keep up, you may find yourself doing all the hard work with very little payback. You could also find yourself liable for the mistakes they make along the way. Alternatively, if you partner has capital but you have all the ideas, you risk them stealing your ideas and profiting from them on their own. Avoid such matters by ensuring you only partner with someone who can bring more than money to the table, and always ensure you have a contract that clearly outlines the duties and responsibilities of each party.

House-Flipping at a 10-Year High - Could It Be Right for You?

House-flipping, defined as a house that is bought, revamped, and then sold within a 12-month period, is now sitting at a 10-year high. Experts say popular television shows are at least partially responsible for this hike. Unfortunately, such shows do not give an accurate portrayal of the industry and the challenges that house-flippers may face during the house-flipping process. Educate yourself on the process, and discover how a seasoned real estate lawyer may be able to help mitigate the risks and potential issues you may deal with along the way.

House-flipping, defined as a house that is bought, revamped, and then sold within a 12-month period, is now sitting at a 10-year high. Experts say popular television shows are at least partially responsible for this hike. Unfortunately, such shows do not give an accurate portrayal of the industry and the challenges that house-flippers may face during the house-flipping process. Educate yourself on the process, and discover how a seasoned real estate lawyer may be able to help mitigate the risks and potential issues you may deal with along the way.

The Pros and Cons of House-Flipping

Under the right circumstances, house-flipping can be a lucrative market. Unfortunately, all the professionals that are needed to complete the process - real estate agents and brokers, builders, construction crews, etc - cut into your bottom line. You can increase your profits by learning more about the industry and expanding your knowledge (i.e. becoming a real estate agent), but one cannot realistically handle all aspects of their deals.

Tariffs Already Affecting Prices in the CRE Market

There is only one true constant in the commercial real estate market: prices change and fluctuate on a regular basis. Unfortunately, those changes in the market can dramatically affect the success of a project. Consider those who are currently under contract and facing price hikes from the recently imposed tariffs; many are starting to realize that they cannot complete their projects within their proposed budgets, so they may be forced to either abandon their ventures or hope that the losses can be made up elsewhere. However, there are some benefits to the tariffs for existing real estate developers, and those that are facing challenges because of the tariffs can mitigate the issues. Learn more, including how a skilled real estate attorney can help.

There is only one true constant in the commercial real estate market: prices change and fluctuate on a regular basis. Unfortunately, those changes in the market can dramatically affect the success of a project. Consider those who are currently under contract and facing price hikes from the recently imposed tariffs; many are starting to realize that they cannot complete their projects within their proposed budgets, so they may be forced to either abandon their ventures or hope that the losses can be made up elsewhere. However, there are some benefits to the tariffs for existing real estate developers, and those that are facing challenges because of the tariffs can mitigate the issues. Learn more, including how a skilled real estate attorney can help.

Tariffs and New Project Budgets

International Investment in the U.S. CRE Market - What Does It Mean for Local Investors?

According to data from the National Association of Realtors (NAR), nearly one-fifth of realtors closed a sale with an international client in the year 2017. Moreover, a total of 35 percent of realtors stated that they have seen an increase in the number of international clients over the past five years. What does all this mean for local commercial real estate investors, and how can you ensure future growth of your real estate portfolio? The following information explains.

According to data from the National Association of Realtors (NAR), nearly one-fifth of realtors closed a sale with an international client in the year 2017. Moreover, a total of 35 percent of realtors stated that they have seen an increase in the number of international clients over the past five years. What does all this mean for local commercial real estate investors, and how can you ensure future growth of your real estate portfolio? The following information explains.

Foreign Investing - Good or Bad for Local Investors?

At first glance, it might appear that foreign investments are negatively impacting local investors, but that is not necessarily the case. Market trends showed an acceleration for the last quarter, with a 9.1 percent increase in sales volume. Granted, investors are still concerned over the shortages of available inventory, and wide pricing gaps between buyers and sellers are still an issue. Yet, when one considers that cap rates closed at 10 basis points higher than 2016, it becomes clear that the CRE market is still growing and expanding. In short, the uptick in foreign investment may mean more competition in the CRE industry, but the savvy investor could potentially use this influx to his or her advantage.

Technology and Competitiveness Are Making “Experience” a Critical Component in CRE Development

Consumers have more choices than ever, and thanks to the constant and rapid evolution of technology, those options can be researched and accessed in a matter of seconds. Because of this, companies are having to work even harder to maintain their competitive edge - and that includes commercial real estate businesses. Environmental experience is one of the key, creative elements that they are using to draw in and maintain a strong, thriving customer base. Learn more about how you can incorporate this element into your commercial real estate business, and discover how a seasoned commercial real estate lawyer can help to further increase your profits.

Consumers have more choices than ever, and thanks to the constant and rapid evolution of technology, those options can be researched and accessed in a matter of seconds. Because of this, companies are having to work even harder to maintain their competitive edge - and that includes commercial real estate businesses. Environmental experience is one of the key, creative elements that they are using to draw in and maintain a strong, thriving customer base. Learn more about how you can incorporate this element into your commercial real estate business, and discover how a seasoned commercial real estate lawyer can help to further increase your profits.

What CRE Investors Can Learn from Theme Parks

Theme parks base their entire business on experience. They combine sights, sounds, and even smells to create an immersive experience that both entices and entertains their consumers. Their shops and stores are the bi-product that drives profits, but it is the experience that encourages consumers to spend. They are in an alternate world, and they want to hold onto their experience forever. Of course, this is an overt and blatant example - one that is unlikely to be seen in an office building or high-rise condo, so one must think more creatively in the commercial real estate industry.

Empowering Women in the CRE Industry - What Every CRE Investor Should Know

Although there are more women in the workplace today, statistics indicate that only 9 percent of companies have women at the top. Some of the reasons seem obvious: family conflict and there are still fewer women who remain in the pipeline - but there are some other, more obscure issues at hand.

Although there are more women in the workplace today, statistics indicate that only 9 percent of companies have women at the top. Some of the reasons seem obvious: family conflict and there are still fewer women who remain in the pipeline - but there are some other, more obscure issues at hand.

One news source, which interviewed some of the leading women in business, cited issues with how women are raised. Others say that the biggest issues related to the continued biases on gender. Whatever the case, and regardless of the reasons, there are companies who are choosing to set the example - and for good reason.

Understanding the Benefits of Diversity in the CRE Industry

Diversity can greatly benefit a company - and not just because it provides them with a broader view of their consumer's needs. A small study found that women-founded businesses tend to grow faster than those founded by men. Moreover, 75 percent of the fastest growing companies (experiencing growth of 200 percent or more) were founded by women. When one also takes into account that only 14 percent of all start-up businesses were founded by women, the weight of that statistic becomes staggering.

Construction Corruption - What Every CRE Investor Should Know

Commercial real estate investors heavily rely on the work of construction companies. Sadly, corruption within the construction industry is costing investors millions of dollars each year. Learn how you can mitigate against such issues during your next real estate transaction, and discover how the aid of a competent real estate attorney can save you both time and money.

Commercial real estate investors heavily rely on the work of construction companies. Sadly, corruption within the construction industry is costing investors millions of dollars each year. Learn how you can mitigate against such issues during your next real estate transaction, and discover how the aid of a competent real estate attorney can save you both time and money.

Construction Corruption is Rampant in CRE Development

One would like to believe that the stories of corruption are one-offs, rarities that can be easily avoided. Unfortunately, nothing could be further from the truth. Corruption in form of bribery, larceny, extortion, grafting, and bid-rigging are rampant in the construction industry, and CRE developers are some of the most heavily impacted victims. If hit severely or frequently enough, corruption could have a permeant and catastrophic effect on a developer's bottom line.

Examining How Driverless Cars Could Impact the CRE Market

With autonomous cars becoming more commonplace, experts are now saying that it is no longer a matter of "if" the commercial real estate market will be impacted, but "when." Smart investors know that means they need to start planning now - before the future arrives. Learn more about how you can stay ahead of the trend of driverless cars, and discover how the assistance of a seasoned commercial real estate lawyer can help you mitigate against the potential issues that may arise along the way.

With autonomous cars becoming more commonplace, experts are now saying that it is no longer a matter of "if" the commercial real estate market will be impacted, but "when." Smart investors know that means they need to start planning now - before the future arrives. Learn more about how you can stay ahead of the trend of driverless cars, and discover how the assistance of a seasoned commercial real estate lawyer can help you mitigate against the potential issues that may arise along the way.

Autonomous Cars and CRE Development

To be successful as a CRE developer, one needs to stay ahead of the trends, but autonomous cars are not just a trend; they are becoming a way of life. The government believes they have the ability to reduce the number of traffic fatalities that America experiences each year, so they are pushing to have more cars developed and tested. People and businesses are responding, en mass. In fact, rideshare companies are already using autonomous cars to increase their profit margin. Countless others are hoping to follow suit.